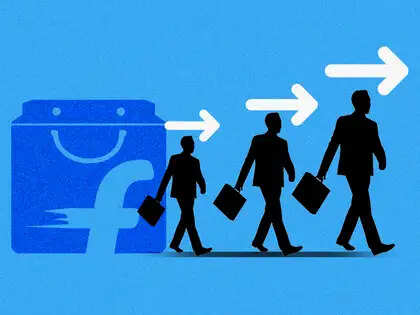

Swiggy Stock Dips After Share Unlock

Swiggy’s stock experienced a significant downturn, plunging 6% to a 52-week low. This drop follows the expiry of a lock-in period that unlocked a substantial 83% of the company’s shareholding.

Impact of the Share Unlock

The unlocking of a large percentage of shares inevitably introduces increased selling pressure into the market. Shareholders, previously restricted from trading their holdings, now have the opportunity to liquidate their positions. This influx of shares available for sale can drive down the stock price.

Factors Contributing to the Decline

Several factors could be contributing to this immediate sell-off:

- Profit-Taking: Early investors may be taking profits after a period of waiting.

- Market Sentiment: General market conditions and investor sentiment towards the tech sector may also play a role.

- Future Outlook: Some shareholders might have concerns about Swiggy’s future growth prospects or competitive landscape.

What Does This Mean for Swiggy?

While a stock price decline can be concerning, it is important to view it within the context of the overall business. Swiggy’s underlying performance, user growth, and market share are crucial factors to consider. The company’s ability to innovate and adapt to changing market dynamics will ultimately determine its long-term success.

Potential Rebound

The stock may rebound if the company announces positive news, such as strong earnings reports or significant partnerships. Investors will be closely monitoring Swiggy’s performance in the coming quarters.

Leave a Reply