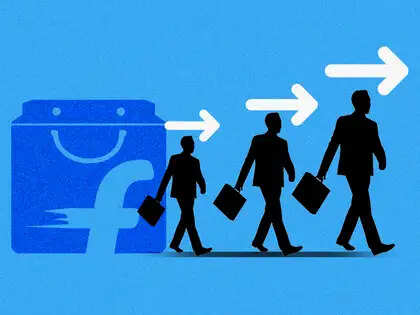

Why Ant Financial is Reducing its Paytm Stake

The decision by Ant Financial to reduce its stake in Paytm comes amid rising geopolitical tensions. Several factors are contributing to this strategic shift. Here’s a breakdown:

Geopolitical Considerations

Geopolitical tensions between countries are playing a significant role. These tensions can create a challenging regulatory environment for businesses operating across borders, particularly in the fintech sector. Navigating complex regulatory landscapes can become increasingly difficult, influencing investment decisions.

Regulatory Scrutiny

Increased regulatory scrutiny in various markets is also a key factor. Governments are paying closer attention to cross-border investments, especially those involving companies with significant data holdings or potential national security implications. This scrutiny adds uncertainty and potential compliance costs.

Strategic Realignment

Ant Financial’s decision may also be part of a broader strategic realignment. The company could be focusing on other markets or exploring new opportunities that align better with its long-term growth strategy. Divesting from certain investments may free up capital for these new ventures.

Market Conditions

Market conditions and investment climate play a crucial role. Changes in investor sentiment or economic forecasts can influence investment decisions. A perceived decline in the growth potential of a specific market could prompt a company to re-evaluate its investment strategy.

Potential Impact on Paytm

While the reduction in Ant Financial’s stake may raise some concerns, Paytm has established itself as a major player in the Indian digital payments market. It’s likely Paytm will continue its operations with other investors supporting it. The long term impact remains to be seen.

Leave a Reply